Parivahan Hypothecation

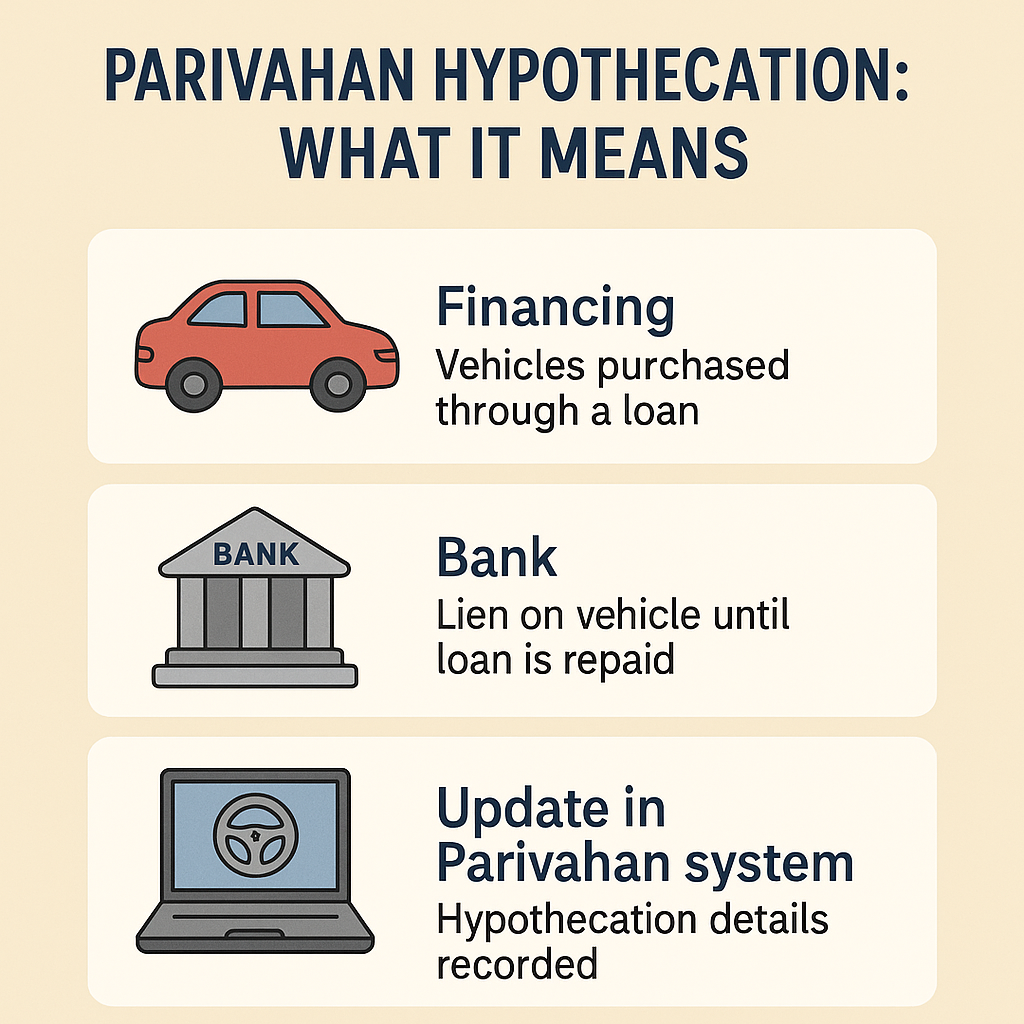

If you’ve taken a vehicle loan in India, you might have come across the term hypothecation of vehicle. But what exactly is Parivahan hypothecation, and why does it matter?

In simple terms, hypothecation means pledging your vehicle as collateral to the lender until the loan is fully paid. This status is recorded in your vehicle’s Registration Certificate (RC) through the Parivahan portal, showing the vehicle is under a loan lien.

Let’s break down Parivahan hypothecation and how vehicle hypothecation works in India.

How Does Hypothecation of Vehicle Work in India?

Parivahan hypothecation refers to the entry made in the vehicle’s RC, via the Parivahan portal, indicating that the vehicle is hypothecated or pledged against a loan. This legal record shows that the lender (usually a bank or financial institution) has a security interest in the vehicle.

The hypothecation status prevents the owner from selling or transferring the vehicle without lender approval until the loan is cleared.

How Does Hypothecation of Vehicle Work in India?

When you take a vehicle loan, the lender places a hypothecation on the vehicle, meaning they have a legal claim on it until you repay the loan fully. Here’s the process:

- Loan Agreement: You agree to the loan terms with the bank or financier, using your vehicle as collateral.

- Hypothecation Entry: The lender requests the RTO to add the hypothecation details in your vehicle’s Registration Certificate (RC) through the Parivahan portal.

- Restricted Transfer: Until the loan is cleared, the vehicle cannot be sold or transferred without the lender’s consent.

- Loan Repayment: Once you finish paying the loan, the lender issues a No Objection Certificate (NOC) confirming the loan is cleared.

- Removal of Hypothecation: Using this NOC, you can request the RTO to remove the hypothecation entry from the RC, giving you full ownership rights.

This system protects lenders while allowing vehicle owners to use their vehicles during the loan period.

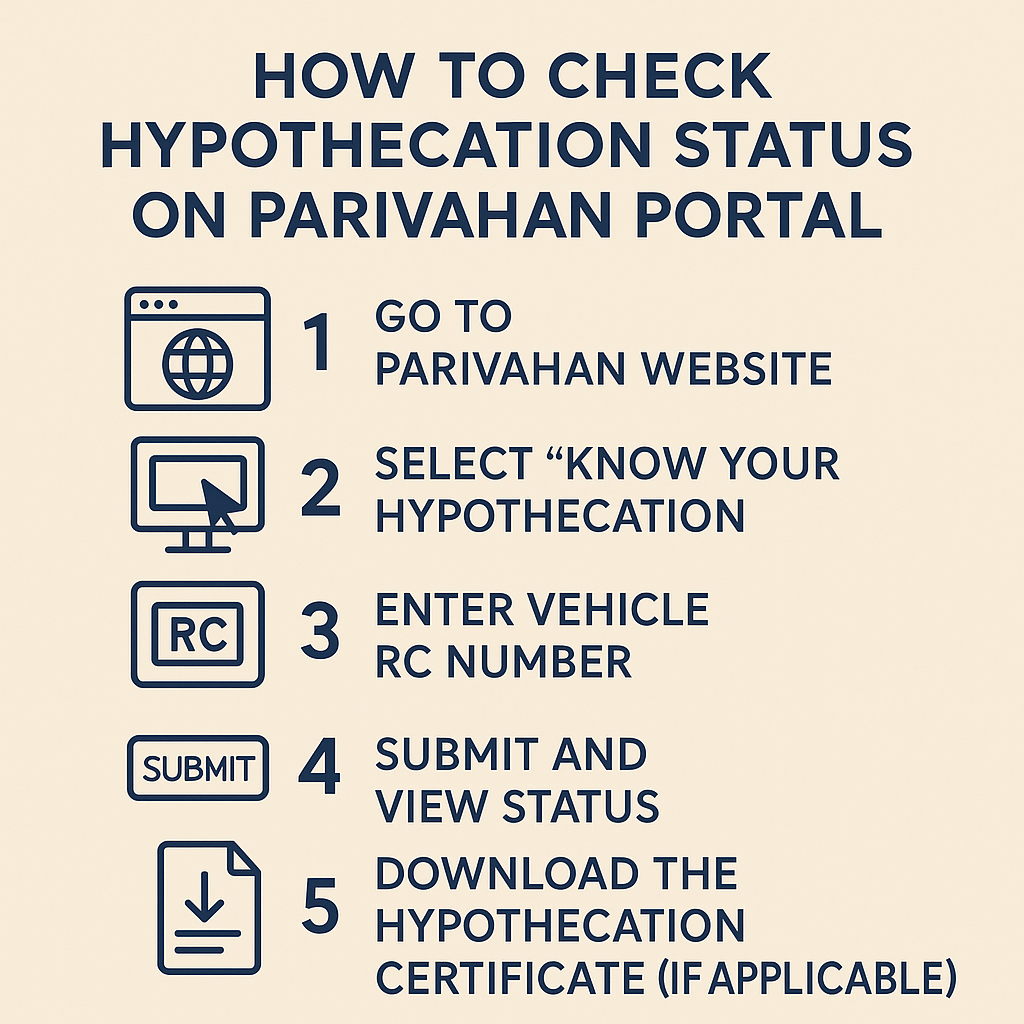

How to Check Hypothecation Status on Parivahan Portal

Checking your vehicle’s hypothecation status is easy and important to know if there’s any loan or lien recorded against it. Follow these steps:

- Visit the Parivahan Sewa Portal: Go to parivahan.gov.in.

- Select ‘Online Services’: Navigate to the ‘Vehicle Related Services’ section.

- Enter Vehicle Registration Number: Input your vehicle’s registration number in the search box.

- View Details: The portal will display the hypothecation status under the owner and financer details section.

- Download Report (Optional): You can download the vehicle details report for your records.

This helps you verify if the vehicle is under a loan, which is especially useful before buying a used vehicle.

How to Remove Hypothecation from Vehicle RC

Once you’ve fully repaid your vehicle loan, it’s important to remove the hypothecation entry from your Registration Certificate (RC) to gain full ownership. Here’s how you do it:

- Obtain No Objection Certificate (NOC): Get an NOC from your lender or bank confirming the loan is fully paid and there are no outstanding dues.

- Prepare Required Documents: Collect your RC book, NOC, insurance papers, address proof, and a copy of your loan closure statement.

- Visit Your Local RTO: Submit an application to remove hypothecation along with the documents. Some states also allow this process online via the Parivahan portal.

- Verification: The RTO will verify the documents and process your request.

- Updated RC Issued: Once approved, you’ll receive a new RC without the hypothecation clause, confirming you have clear ownership.

Removing hypothecation is essential before selling or transferring your vehicle.

Importance of Hypothecation for Vehicle Loans

Hypothecation plays a crucial role in the vehicle loan process for both lenders and borrowers:

- Security for Lenders: It gives banks or financial institutions legal assurance that the vehicle is collateral until the loan is fully repaid.

- Lower Interest Rates: Since the loan is secured by the vehicle, lenders often offer better interest rates compared to unsecured loans.

- Access to Vehicle Use: Borrowers can use the vehicle while repaying the loan, unlike some loans that require collateral to be held physically.

- Prevents Unauthorized Sale: Hypothecation ensures the borrower cannot sell or transfer the vehicle without lender approval, protecting the lender’s interest.

- Clear Ownership After Loan: Once the loan is cleared and hypothecation removed, the borrower gets full ownership and freedom to sell or transfer the vehicle.

Understanding hypothecation helps you manage your vehicle loan better and ensures a smooth ownership experience.

FAQs

Conclusion

Understanding Parivahan hypothecation and the hypothecation of vehicle is vital when dealing with vehicle loans in India. It protects lenders while allowing borrowers to use their vehicles during the loan tenure. Knowing how to check hypothecation status and remove it after repayment ensures a hassle-free ownership experience. Always keep your documents updated and use the Parivahan Sewa portal to manage your vehicle’s hypothecation smoothly.